Purification and Growth

“Take, [O, Muhammad], from their wealth a charity by which you purify them and cause them to increase…” (Quran 9:103)

This ayah emphasises that Zakat purifies the giver’s wealth and soul, and is believed to bring blessings and growth in their remaining possessions.

Promotion of Social Equality

The Prophet Muhammad ﷺ said, “Give the Zakat of your wealth; it is a purifier which purifies you.” (Sahih Muslim)

Zakat is a means to redistribute wealth in society, reducing the gap between rich and poor, and promoting social justice and equality.

Eradication of Greed

Zakat is a means to “And those in whose wealth there is a recognised right for the (needy) petitioner and the deprived” (Quran 70:24-25)

This practice helps in controlling and eradicating greed and selfishness, fostering a spirit of empathy and generosity.

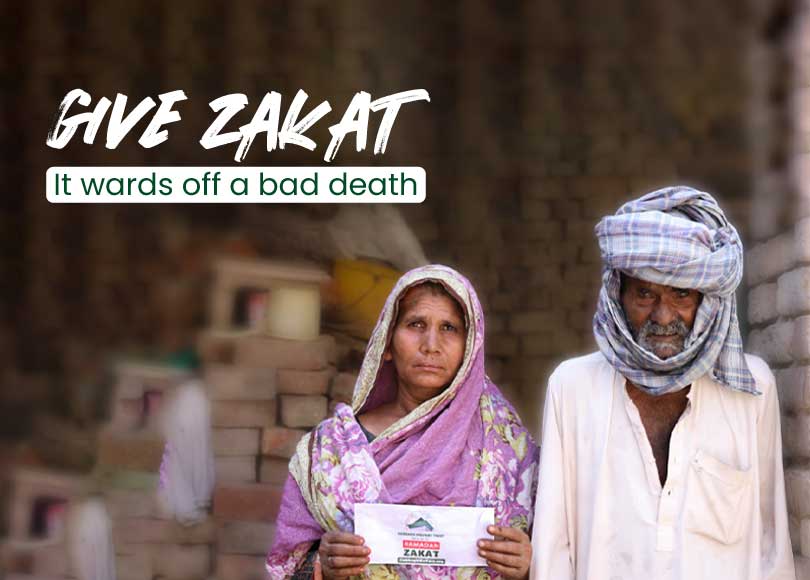

Divine Reward and Protection

The Prophet Muhammad ﷺ said, “Charity extinguishes sin as water extinguishes fire.” (Tirmidhi)

Zakat is seen as a way to earn Allah’s pleasure and protection from various kinds of harm and sins.

Strengthening Faith and Spirituality

“But the righteous will be in gardens, and in happiness, enjoying what their Lord has given them, and their Lord protected them from the punishment of Hellfire. [It will be said], ‘Eat and drink in satisfaction for what you used to do.’ They will be reclining on thrones lined up, and We will marry them to fair women with large, [beautiful] eyes. And those who believed and whose descendants followed them in faith – We will join with them their descendants, and We will not deprive them of anything of their deeds; [every] person for what he earned is retained.” (Quran 52:17-21)

Regularly giving Zakat strengthens a Muslim’s faith and spiritual connection with Allah.

Guarantee of Blessings in the Hereafter

The Prophet Muhammad ﷺ said, “Charity does not in any way decrease the wealth and the servant who forgives, Allah adds to his respect; and the one who shows humility, Allah elevates him in the estimation (of the people).” (Sahih Muslim)

By giving Zakat, Muslims are promised blessings and a higher rank in the Hereafter.

Fostering Community Solidarity

“Zakat expenditures are only for the poor and for the needy and for those employed to collect [zakat] and for bringing hearts together [for Islam]…” (Quran 9:60)

Zakat is a tool for fostering unity and solidarity within the Muslim community, ensuring care for those who are vulnerable.